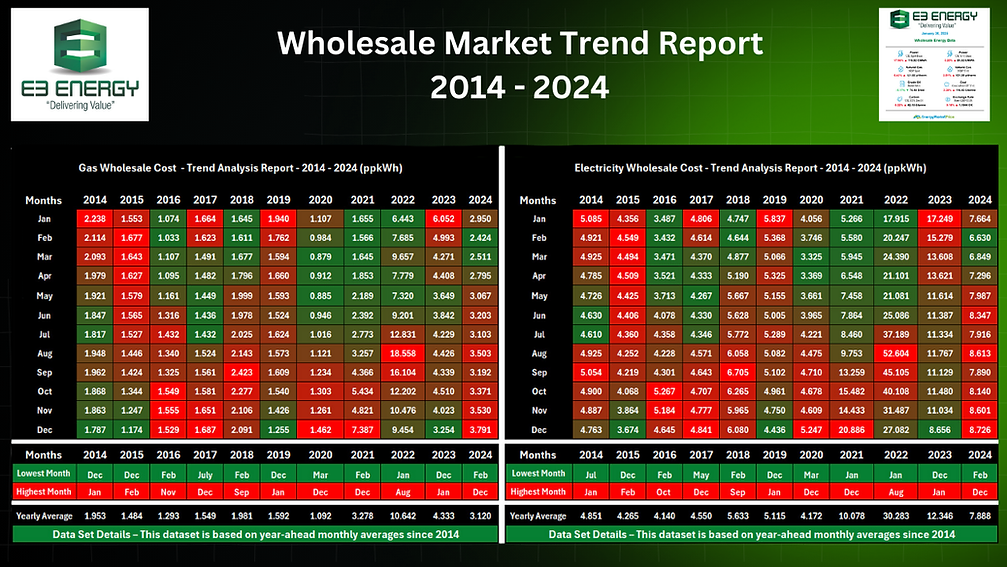

Energy Market Trend Analysis

2014 - 2024

This article has been created to offer detailed insights into energy wholesale market trends since 2014, providing guidance on procurement optimisation strategies for your 2025 and 2025 contract renewal anniversaries. It highlights key trends in the energy wholesale market over the past decade, delivers actionable insights into price fluctuations, and offers recommendations for optimising procurement strategies. The aim is to assist stakeholders in achieving cost efficiency through well-timed energy procurement.

Key Yearly Observations:

2014–2018: A period of relatively stable and decreasing prices.

-

2014 begins with higher prices in January, trending lower into late 2015 and 2016.

-

Seasonal patterns remain consistent; however, overall prices decrease between 2014 and 2016. Increases are observed in 2017 and 2018, driven by factors such as the "Beast from the East," rising oil prices, the 2016 Brexit referendum, and the weakening of the British pound.

2019–2020: A period of price volatility followed by a sharp decline.

-

2019 was marked by significant unpredictability, driven by the emergence of the COVID-19 pandemic and the implementation of the first lockdown in March 2020

-

2020 experiences a significant price drop across most months, reflecting market shocks linked to reduced demand and oversupply caused by the pandemic's economic impact.

2021–2023: A sharp rise in prices, indicating heightened market instability.

-

Prices began climbing significantly in August 2021. One of the main factors was that the Nord Stream 1 pipeline faced various complexities and experienced major reductions in flows, which impacted the energy markets. This trend continued into 2022 with Nord Stream 2, as Germany’s energy regulator suspended its approval. Nord Stream 2 ultimately filed for bankruptcy on 1 March 2022.

-

The increases continued month-on-month from August 2021 through to November 2022, with the market price peaking at its highest-ever level in August 2022 in the UK energy market. Some of the main contributing factors include the invasion of Ukraine, sanctions on Russia, conflicts in the Middle East, the explosion at the Freeport LNG plant in Texas, and the energy crisis, which exacerbated global supply and demand concerns.

2024: A stabilisation trend emerges, though prices remain above pre-2021 COVID-19 levels.

-

From December 2023, prices begin to stabilise, driven by increased global efforts to enhance gas storage for energy security, robust winter supply, and renewed gas agreements to meet European demand.

-

By August 2024, prices start to rise again due to geopolitical events and the seasonal increase in demand as winter approaches across European countries.

E3 Energy Conclusion and Advise:

The energy wholesale markets exhibit strong seasonal patterns, cyclical trends, and periods of extreme volatility, which have been clearly identified since 2014. The primary drivers of these fluctuations are geopolitical events that disrupt global supply and demand dynamics. Furthermore, seasonal weather patterns are now evident in the data, enabling us to provide advice on optimising the timing of your portfolio’s future tendering activities.

In conclusion, based on the data and seasonal trends observed over the last decade, our team of energy market specialists consistently achieves the best results through structured market cost tendering exercises. These must be conducted at least 10–12 months in advance. This approach ensures that wholesale market movements are effectively benchmarked and optimised, allowing procurement to be secured at the lowest market points for maximum portfolio cost efficiency.

Within the energy wholesale market, consumers can capitalise on seasonal price dips only by employing forward purchasing strategies supported by accurate and live market tendering benchmarks through detailed analysis. This method provides the opportunity to secure optimal pricing through careful timing, strategic procurement planning, and issuing tenders as part of a comprehensive energy procurement strategy. Over the last five years, the historic data has shown that Q1 and Q2 provide the most advantageous purchasing opportunities. Supported by 11 years of historical analysis, these periods should be prioritised when planning for your 2025 and 2026 contract renewal anniversaries.

We have a detailed trend analysis report that is available on request, via insight@e3energy.co.uk

Contact us today

Contact us today for a comprehensive assessment of your energy requirements. Our expert team will provide professional advice on the optimal timing for your upcoming energy renewals in 2025 and 2026. At E3 Energy, we offer detailed portfolio analysis reports and insights into forward wholesale market prices, sourced from our extensive renewable energy suppliers network across the UK marketplace. This ensures your portfolio benefits from full access to the UK’s leading energy providers.